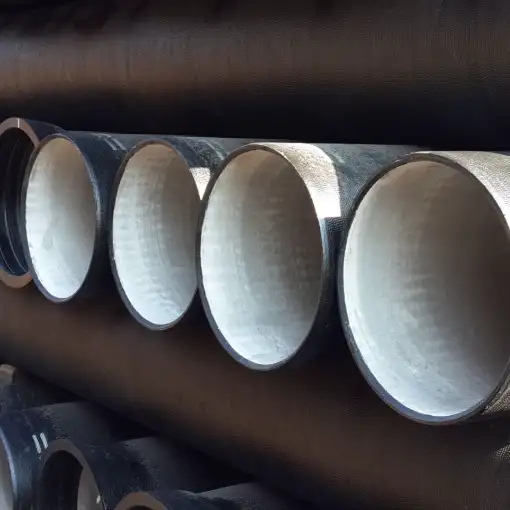

Kenya’s infrastructure expansion fuels unprecedented demand for reliable water transmission systems. With over 70% of major urban water projects specifying ductile iron pipes (DIP) for their exceptional pressure tolerance and lifespan exceeding 100 years, procurement professionals face complex choices. We’ve analyzed import records, supplier capabilities, and technical specifications to identify Kenya’s top five DIP sources balancing cost, quality, and support.

1. Kenyan DIP Market in 2025

1.1 Demand Drivers

Kenya’s urbanisation and regional irrigation efforts are fueling growth in piping demand. As of 2023, the regional market for ductile iron pipes and fittings in Eastern Africa was valued at approximately USD 495 million, and projected to reach USD 824 million by 2030. Kenya’s own pipe and fittings import volume has grown steadily.

1.2 Major Importers & Supply Routes

Data from trade platforms like Volza show that from November 2023 to October 2024, six shipments of ductile iron pipes entered Kenya—primarily via Helpdesk Engineering Tanzania, which accounted for all recorded imports. Leading sources include China (via CNBM/Okorder), India, and occasionally Austria.

Noteworthy importers include AVIC International, Vambeco, Zhonghao Overseas, and regional traders. Suppliers like TradeKey-linked exporters like Valpro and Shreeni also stock in Nairobi, easing local access.

1.3 Price Dynamics

FOB prices from Chinese or Indian manufacturers typically range USD 260–330/ton. High-end Austrian brands may fetch USD 330–360/ton. Once landed in Kenya (with freight, duties, and taxes), C-class pipe DN300 (8″) can cost USD 45–65 per metre. For context, plastic pipes from global surveys in Kenya average about USD 2,788/ton, showing DIP is competitively priced given quality .

2. Top Five Suppliers to Kenya

Below is an annotated table summarizing the five best-known suppliers in 2025:

| Supplier | Origin | Standards | Estimated Price (FOB) | Local Delivery in Kenya | Value-Added Services |

|---|---|---|---|---|---|

| Luokaiwei / CNBM (China) | China | ISO 2531, EN 545/598 | USD 260–300/ton | 6–10 weeks | Tech support, project engineering |

| Imco International (India/EMEA) | India | ISO/EN/BS, WRAS-approved coatings | USD 270–320/ton | 8–12 weeks | Self-restrained joints, QC audits |

| Valpro & Shreeni (Kenyan ex-stock) | Kenya | C-class, basic ISO 2531 | USD 250–320/ton FOB | 4–6 weeks | Small-lot orders, fast delivery |

| Xylem Kenya (local subsidiary) | Kenya | AWWA, ISO 2531, EN | Market-driven | Local stock | Engineering support, warranty support |

| Tiroler Rohre / TRM (Austria) | Austria | EN/ISO, 75 years manufacturing | USD 330–360/ton | 10–14 weeks | High-end innovation, life-cycle services |

*Note: FOB prices depend on pipe diameter, pressure class, coating type. Landed costs in Kenya include freight (~USD 50–60/ton), import duties per EAC regulations, port handling, trucking, and VAT.

3. Technical Comparison by Diameter

Below are typical landed costs for C‑class pipe in Nairobi. Values vary with coating and quantity.

| Diameter (DN) | Thickness (mm) | Weight (kg/m) | Standards | Coating | Estimated Cost (USD/m) |

|---|---|---|---|---|---|

| 100 mm | 3.4 | 9.6 | ISO/EN | Zinc + bitumen | 14–18 |

| 300 mm | 8.6 | 38.5 | C-class | Zinc + LPS | 45–65 |

| 600 mm | 16.7 | 142.0 | ISO/EN | Zinc + LPS | 120–150 |

Coating abbreviations: LPS = loose polyethylene sleeve.

4. Case Study – Nairobi Water Supply Upgrade

In 2023, Nairobi’s water utility embarked on a major pipeline rehabilitation for core DN300–600mm mains. They chose ISO 2531 C‑class ductile iron pipe, supplied by Imco International (Indian origin), with self-restrained Push-On® joints.

-

Installation costs: Slightly higher than flexible joint systems, but offset by better axial restraint and reduced excavation.

-

Operational results: 30% reduction in leaks within first year.

-

Burst incidents: Zero documented failures.

-

Life-cycle savings estimate: USD 5 million over 50 years, compared to PVC or HDPE alternatives.

The procurement team emphasized: short‑term premium pays off long-term. Engineering lead commented, “The stiffness and integrity of restrained DIP simplified anchoring needs and cut civil works.”

5. Purchase Guide & How to Evaluate

5.1 Certify Standards

Demand compliance per ISO 2531, EN 545/598, and BS 4772. Ask for test certificates, traceable to batches.

5.2 Optimum Coating Strategy

In soils with high acidity or moisture, insist on zinc + polyethylene sleeve. That combo greatly extends pipe life.

5.3 Choose Joint System Carefully

-

Flexible (push‑on) joints: cost-effective, allow thermal movement.

-

Self‑restrained: prevent axial movement under pressure surges; ideal for dead-end mains or high-head zones.

5.4 Understand Pressure Class & Diameter

Class C (PN10) suffices for most urban water mains; Class K or D may be required for higher pressure zones. Critical: match internal diameter with Hazen–Williams friction loss calculations.

5.5 Factor Life‑Cycle Cost

Don’t judge on upfront alone. Account for installation ease, expected maintenance, leak-related losses, and pipe longevity.

5.6 Delivery Time & Local Support

Local stock (Xylem, Valpro, Shreeni) offers 4–6-week delivery—critical for emergency or phased works. International suppliers usually take 8–12 weeks.

5.7 Warranty, After‑Sales & QC

Ask about batch verification records, coating inspection services, traceable certificates, and local warranty options.

6. Frequently Asked Questions

1. What standards should Kenyan DIP shipments meet?

They must conform to ISO 2531 (ductile iron pipes), EN 545 (water), EN 598 (sewer), and BS 4772. Cement mortar lining needs to comply with ISO 4179 or AWWA M41.

2. How much does DN300 C‑class pipe cost per metre when landed in Nairobi?

Typically USD 45–65/m, though variation occurs depending on coating, pressure class, exchange rates, and supplier pricing.

3. What benefits do self‑restrained pipe joints provide?

They resist thrust forces, reduce the need for bulky concrete thrust blocks, and simplify installation in critical network zones. In Nairobi’s 2023 rehab, they ensured zero pipe movement at tee branches under high-pressure spikes.

4. Is loose polyethylene sleeving essential for Kenyan soils?

Definitely. The red volcanic soils around Rift Valley are acidic and high in moisture content. Zinc alone isn’t enough—LPS adds a fail-safe protective barrier.

5. How long will DIP last in Kenya under proper conditions?

With compliant coatings, proper bedding, and periodic inspections, DIP can serve well beyond 100 years—supported by both European and North‑American field data.

7. Conclusion

By selecting suppliers who combine recognized standards (ISO 2531, EN), durable coatings, efficient joint systems, and prompt local support, Kenyan projects can secure real value. The five suppliers profiled here — spanning Chinese mass production, Indian engineering, local stockists, and premium Austrian producers — offer differentiated strengths. When you calculate total life-cycle performance, faster delivery and technical assistance often outweigh marginal price premiums.

As Kenya’s infrastructure becomes more ambitious, decision-makers who weigh technical detail, standards, and support capability will shape pipelines that truly last a century.